Let’s face it- the word “Emergency” doesn’t carry a good reputation at all. This one word often drags along with it a baggage of shocks and of course, some punch of negativity.

Now tell me, can you commit to a lifetime of fear and chaos?

No. No one can.

So, why don’t you keep these emotions at bay and spend the next 7 minutes with me reading about this article on Emergency Fund?

Yes…it’s a fund for those bad days.

That’s what you needed right? To forget about all those uncertainties in life which require a huge sum?

So, are you ready to unlock your financial freedom? I hope you are.

But first…

What is it?

As I mentioned, the emergency fund has your back in deep waters limiting the impact of “Emergency”, at least it minimizes those monetary ripples.

Got it?

This fund shields you and your family when the cash urgency strikes. In other words, this fund adds security to your financial foundation.

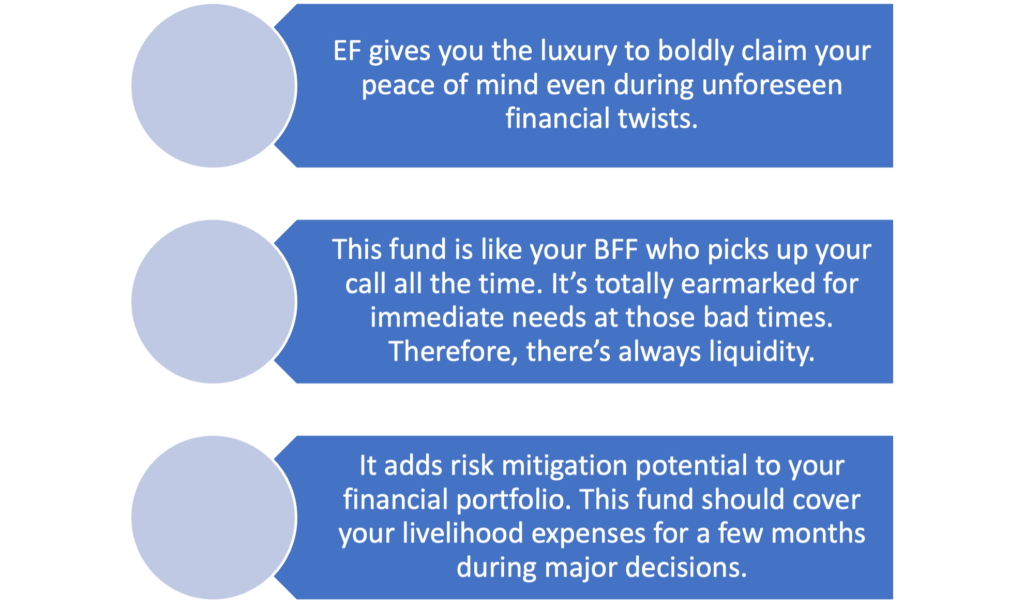

Now, here’s some slick aspects of EF for you…

To unlock all these perks, you gotta give something.

Your attention.

Yes, this fund craves a lot of attention.

Don’t ever forget to shower your EF account with regular contributions. And you will have a savior in tough times.

Why do you need an emergency fund?

I get it, you have a thriving career or some financial support at the moment. But how do you plan to tackle those financially bad days? Any plan?

One should never trade security of future for the abundance of today. It’s a complete no-go.

That’s where the emergency fund shines bright.

At times, life’s uncertainties demand loads of financial resource at once. Better to have a shield against these storms.

Hence, the EF or the Emergency Fund.

Let’s take a step towards preparedness by exploring life’s uncertainties one step at a time…

…the list can go on.

In a nutshell, the fund saves you from a heart attack when you encounter these unpleasant surprises in life.

So, how much money do you need for such a fund?

That depends totally on you. On your lifestyle needs actually.

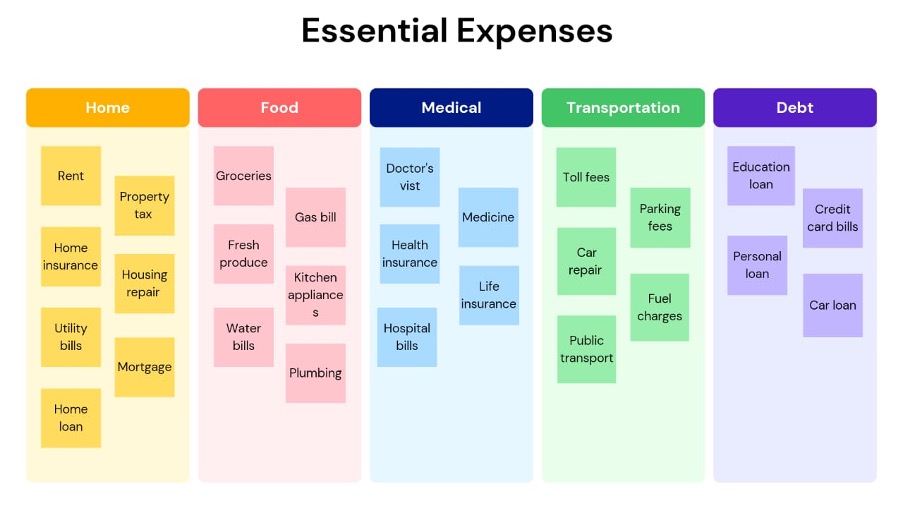

See, the fundamental concept of the emergency fund is to safeguard your basic necessities in life at all costs.

So, when calculating the sum for emergency fund, count the needs for a comfortable livelihood over a few months.

Let’s see what are these ‘must-not-forget’ basic needs.

Now, I hope it’s clear which aspects of your lifestyle need accounting to this fund.

What you can do is- calculate separately the monthly spending on Rent, health insurance etc. and give me the total adding up all your basic necessities.

You can throw in other necessary categories as well for your lifestyle basics. I am just spilling the tea on some general ones here.

How long does this emergency fund have your back?

Well, that’s a really good question.

- If it’s your debut emergency fund as a student or single man/woman, I would say- let’s try 3 months.

- If you’ve been working for a few years- let’s go for EF of 6 months.

- For married couples- 1 year of EF would be enough.

- If you have kids and dependent spouse/ parents living with you – make a safety net of 3 years with this Fund.

You may have guessed already- the longer this fund covers, the better you are at monetary security. And fewer worries, more opportunities.

This Emergency Fund’s worth a shot, huh?

I know what’s going on in your mind now- “I want to save up for this fund but…”

But what?

Where will I get this extra money for Emergency fund?

Well, the emergency fund doesn’t rely on extra income.

You will need to trim from every category a little to afford such a life saver like EF.

Yes.

I will guide on how you can do that without compromising your lifestyle standard.

- First tell me, would you mind having one no-spend weekend a month?

I know, if you really want an EF on your name, you won’t mind much.

- Next, I have a really interesting one. I know even if the first one brings tears on your eyes, this is a must-do for everyone of you.

What’s this?

Cancel all your unused subscription without checking for latest content.

- Swap 2 dine-out Friday nights/ Saturday nights a month for cozy home cooked healthy meal with your partner.

It’s time to embrace the indoorsy vibe.

Just think, this can give you 1 EF + still you are left with 2 Saturday nights a month. It’s a win-win.

- What’s next?

How about selling those dusty items you haven’t touched for years?

These items can help you score some good cash. You can get a swift growth in your EF with this money.

- Can you surrender 10% of your shopping budget or any other ‘want’ budget monthly?

I know you can.

So, follow these sleek cut-down methods, and voila!!

Try to slice and dice your expenses this way for solid 12 months, and you will whip up an EF to cover you for 3 months at least.

Here’s one saving challenge I am tossing your way. Ready?

| EMERGENCY FUND | ||

| 2024 | ||

| Date | Added | Total |

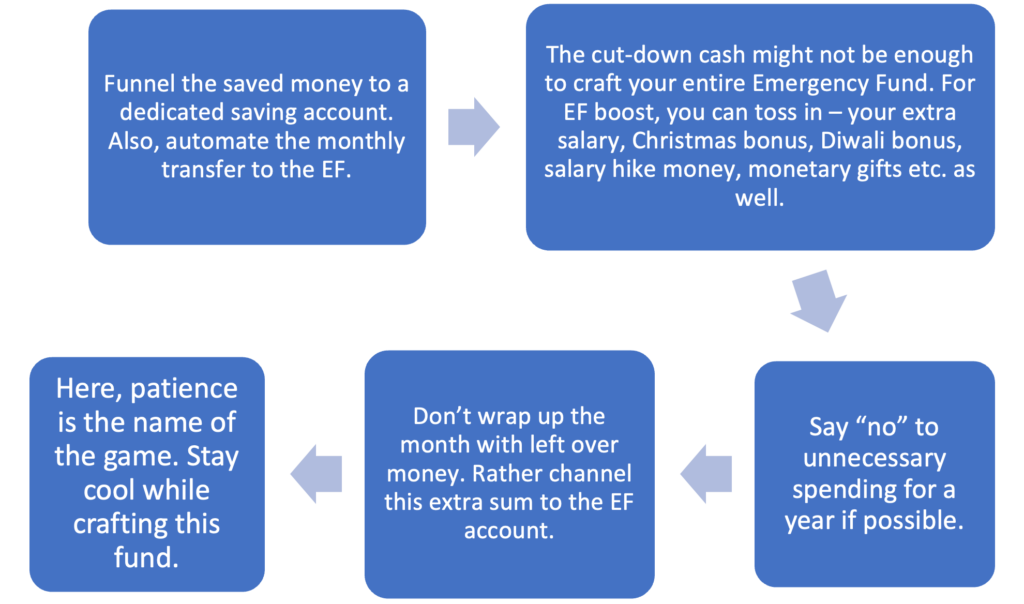

Let’s build the emergency fund:

You already know that you need to trim your expenses a little to afford this EF. Now, what’s left?

And once you hit your EF target, pop it into an FD with highest possible interest rate. But, skip the lock-in period or tax saving ones at any cost.

Keep that liquidity key!!

Break that FD when the emergency you are most afraid of knocks at your doors only.

Keep the Emergency Fund within reach for you and your crew. Trust me, your family will thank you one day for this financial foresight down the road.

But, here’s the real talk- you might need to build these emergency fund more than once in your life.

Because when the emergency wave hits, your EF castle crumbles. Then, you have to be ready to rebuild the fortress.

But, deep down, I wish your EF remains untouched for life.

That’s a wrap for now. Stay in loop for our next article.

Signing Off.