Do you remember how during our childhood our parents used to use envelopes to hand over the fees to our private tutors? I never really got it why they had to waste a completely good envelope for it.

But actually, there are two aspects of this envelope system- one is setting aside the required cash to pay for the education of the child and another is simply not letting the child be involved in finance matter. Anyway, leave the second aspect.

Now just imagine the simplicity – A designated envelope for each and every expense. For those who often miss crucial payments, this life hack can be a true game-changer. With this financial approach all the forgetful payers can escape the “you forgot to pay again” look from their family and friends.

Also, with this old-school envelope technique- you have to invest only once (that too in envelopes), and then reap the benefit for years. Just don’t forget to adjust the amount in those envelopes with the salary bumps. And then there’s that inflation twist as well which will demand you to put more money to these envelopes for a comfortable lifestyle in future.

Wanna know more about this approach? I hope it’s a ‘Yes’.

So, what is this envelope system?

Consider this as an approach to simplify your financial planning by allocating some physical envelopes for different budget categories. Here, each envelope represents a specific category of your lifestyle needs and wants (say food, monthly maintenance fees, school fees of children, foreign travel etc.).

So, you can understand that this envelope system can ensure a disciplined spending for you cultivating a sense of financial responsibility.

Now, today, who has the time for such regular envelope ordering or ATM runs?

No one.

Even, I won’t follow it much longer if I need to order envelopes every time.

So, here’s a simple solution- Go cashless. Sign up for a tech-savvy budgeting.

Introducing the cashless envelope system. Ta-Da!!

Cashless envelope system- Now, what is this?

Here, you will be following the same method of financial planning, only instead of physical cash, you will count on online money.

Already feeling that budget relief, huh?

Well, there’s an easy street for us. Mr. Gates got us covered long back with his Microsoft excel.

Yes, Excel. The one-word solution for your cashless envelope system.

At this stage, don’t worry about the payments. You just have to know how much money you will have to allocate to a specific budget category. Make excel columns for these virtual envelopes (or budget categories).

And you can maintain one bank account for all these envelopes.

Yes, all you have to do is deduct the amount of money you have already spent from a particular category and spend wisely keeping in mind the rest of the money left in that envelope.

What’s next?

Envelope Budgeting categories:

Budget category, budget category, budget category!!!! Aaaahh!!!!! What are these?

All these were your envelopes for Lifestyle need category (the most general budget categories- common for almost everyone).

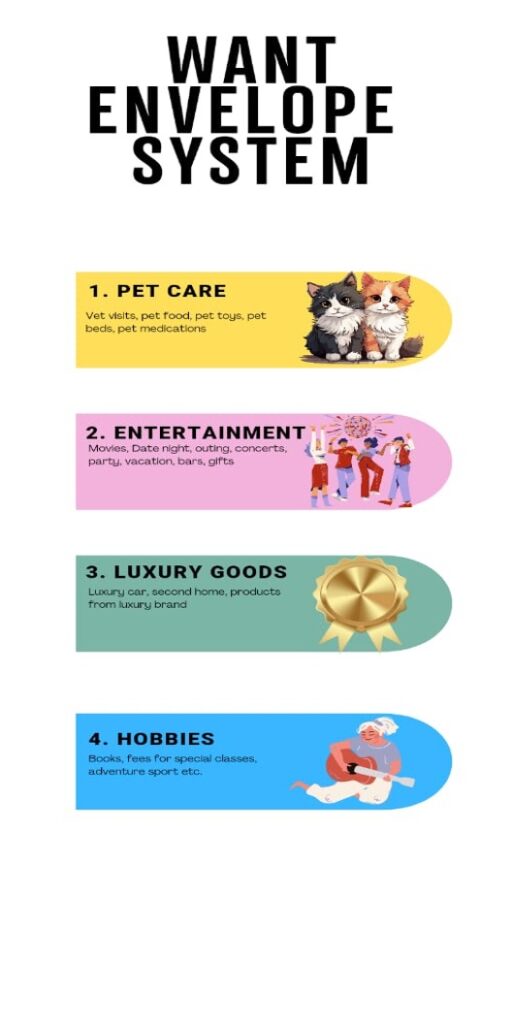

Now, let’s see what the Want envelopes are.

Now, we have saved the most important envelopes for the last.

Yeah, you have guessed right. These are Savings and Investment envelopes- where your financial dream will meet reality.

Now, there’s another envelope everyone should consider having.

The miscellaneous envelope.

Save this wildcard for unpredictable only like bank fees, credit card fees, taxes, medical emergencies and lending love.

How to set up this envelope system?

Now, let’s commit to this envelope budgeting in 6 simple steps.

Are you ready?

1. Know your requirements at first

Just because I have talked about a few important budget categories earlier, doesn’t mean all these envelopes will come to your use.

That’s why start this envelope budgeting by jotting down the must haves as per your lifestyle needs.

Then?

Just groove into categorizing.

2. Fund allocation

This part is quite fun. This is where you will have to decide how much money you will be needing for a particular budget category. And then stash it into the envelope for the entire month.

If you are going for cashless envelope system, why don’t you use the Bank FD format as envelope for saving up a certain amount of money? And when it is time to actually use the money, use the credit card. This way, you will get more reward points.

Hey, don’t forget, you can always make FD envelopes (normal fixed deposits) of less than a month duration if you want.

All you have to do is keep your finance moves in check with an excel sheet.

That’s it.

3. Spending discipline

Here, you will have to take a vow that at no cost you will spend more than you have allocated in an envelope. This can give you a total control on your finance with zero budget slip.

That’s all we want, right?

4. Overspending? It’s a NO-NO.

The entire point of this envelope system is to stop you from overspending.

If an envelope needs more money, don’t you dare go raiding other envelopes.

Rather take some from the “extra money/ miscellaneous” envelope.

If this envelope remains untouched, well, congratulations!!!

Let it grow for a month. Save it up for those unforeseen expenditures in future.

5. End of the month

In the end of the month, if there is certain amount of money left to these envelopes, you can always roll it over to the next month keeping them in those envelopes for specific budget categories.

Or, simply elevate your “Extra money/miscellaneous” envelope reserve.

6. Budget adjustment

If you see one of your envelopes constantly overflowing, treat yourself to a ‘want envelope’ with this surplus amount.

Or, you can always add another financial goal for your future milestones.

So, this is it.

It’s an honest opinion that this envelope system can really sort you financially. If you religiously follow it every month, at least overspending won’t be a problem in your life anymore. That’s a guarantee.

What do you say? Isn’t this envelope system worth a try? Let us know in the comments below.